Index

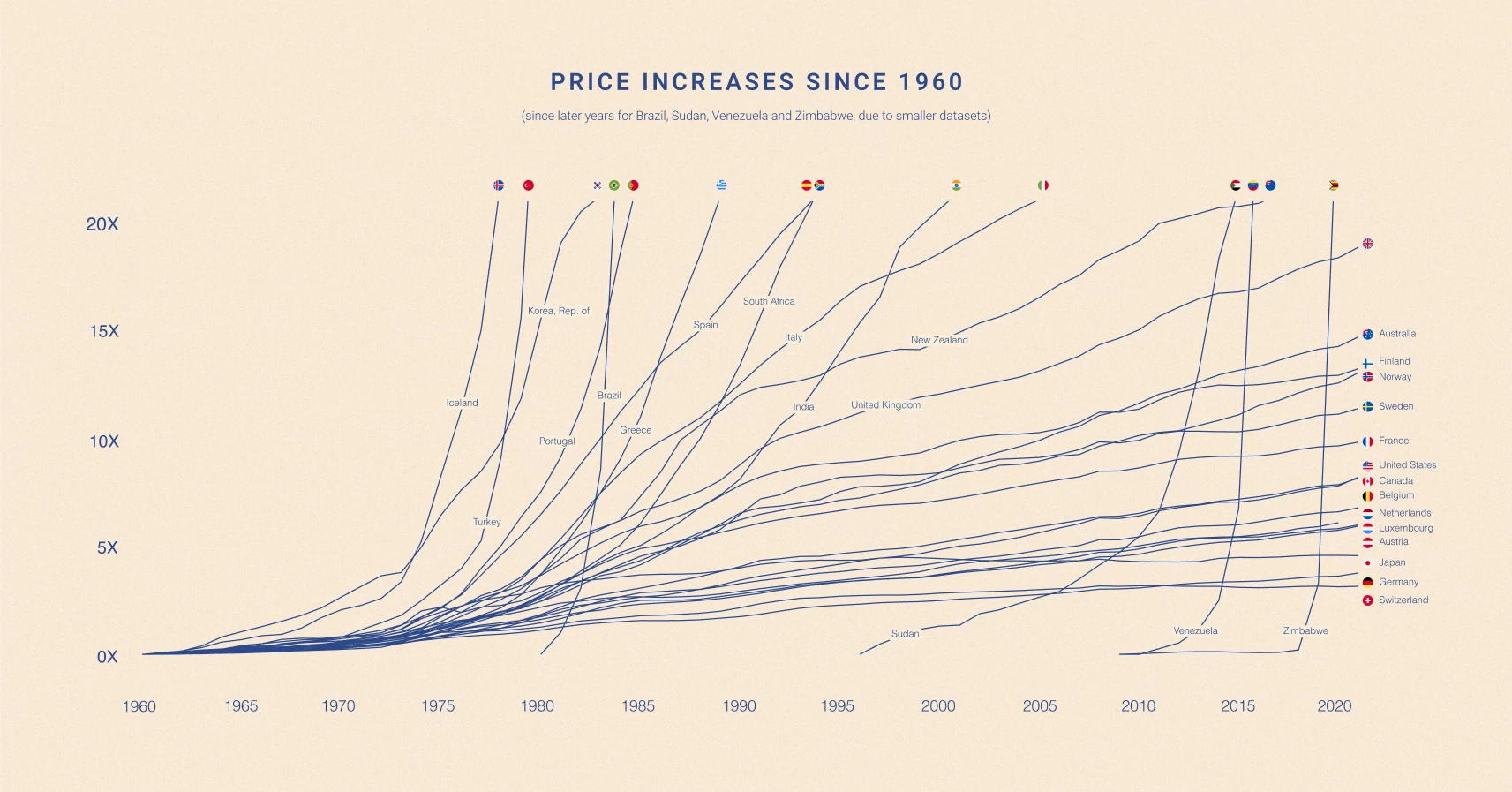

the world

Package crypto markets, sectors and strategies into one-click indexes–transparent & decentralized on the blockchain.

Reserve lets anyone launch, mint, and redeem onchain crypto indexes called Decentralized Token Folios (DTFs) with battle-tested, safety-first smart contracts.

Get broad crypto exposure, earn easy DeFi yield, or create the next world reserve currency.

Package crypto markets, sectors and strategies into one-click indexes–transparent & decentralized on the blockchain. Continue reading...

Reserve lets anyone launch, mint, and redeem onchain crypto indexes called Decentralized Token Folios (DTFs) with battle-tested, safety-first smart contracts.

Get broad crypto exposure, earn easy DeFi yield, or create the next world reserve currency.

Backed 1:1

Backed 1:1